I went into the bank today to get some cash. This is a small town and everyone knows everybody. The cashier said " you farm" go see the manager. I went to his office and he mentioned some program where using 2019 taxes, form F, you get a govt loan and then they forgive it. I said I don't want a loan we have money in savings and owe nothing. He said they have this program and the fact that we don't need a loan is not relevant. This doesn't make sense. Anybody know anything?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Govt program

- Thread starter farmguy

- Start date

Help Support CattleToday:

TexasBred

Well-known member

Sounds like the Payroll Protection Program. I have no idea if you would/could qualify or not. I do know several that received funds and said nothing had been affected at all by covid in their business but they took the money.

TexasBred is right, it sounds like the PPP program. You have to have employees to qualify. If you prove it was used for payroll (and a couple of other things) and you don't lay off any workers, they will forgive the loan.

https://www.usda.gov/coronavirus/loans-and-grants

https://www.usda.gov/coronavirus/loans-and-grants

littletom

Well-known member

You are an employee of your farm. This round is based on gross income i think divided by 12.5 x 2.5. Long story short if you sold 144000 you get max amount of 20800. Agree or disagree alot of farmers are doing it through local banks. Some peoples numbers are on the up and up some not so much. Its pretty popular in my parts.

Silver

Well-known member

Sounds socialist.

Lee VanRoss

Well-known member

- Joined

- Apr 26, 2020

- Messages

- 2,392

- Reaction score

- 2,682

Sounds like PPP which I doubt helps the one man band. Silver... I hope you have one of those good 4pt Hudson Bay Blankets.

calfmomma

Active member

Hi all,

Just went through the very simple process of getting a PPP loan for my husband as he is the sole proprietor on our farm.

Our Ag lender called us and asked him to fill out the 1st Round PPP document, using Line 9 from our schedule F.

Under the Payroll line we took line 9 divided by 12 then multiplied by 2.5. I turned in the application this am and it was approved before an hour was up.

Our line 9 is small potatoes- so the catch- to speak of- 60% of your loan must go to payroll or operating expenditures. Not a big deal, we have a business account and a personal account, our lender advised us to write a personal check from the loan account to the personal account and call it an employee disbursement.

Just went through the very simple process of getting a PPP loan for my husband as he is the sole proprietor on our farm.

Our Ag lender called us and asked him to fill out the 1st Round PPP document, using Line 9 from our schedule F.

Under the Payroll line we took line 9 divided by 12 then multiplied by 2.5. I turned in the application this am and it was approved before an hour was up.

Our line 9 is small potatoes- so the catch- to speak of- 60% of your loan must go to payroll or operating expenditures. Not a big deal, we have a business account and a personal account, our lender advised us to write a personal check from the loan account to the personal account and call it an employee disbursement.

Thank you for sharing your experience.Hi all,

Just went through the very simple process of getting a PPP loan for my husband as he is the sole proprietor on our farm.

Our Ag lender called us and asked him to fill out the 1st Round PPP document, using Line 9 from our schedule F.

Under the Payroll line we took line 9 divided by 12 then multiplied by 2.5. I turned in the application this am and it was approved before an hour was up.

Our line 9 is small potatoes- so the catch- to speak of- 60% of your loan must go to payroll or operating expenditures. Not a big deal, we have a business account and a personal account, our lender advised us to write a personal check from the loan account to the personal account and call it an employee disbursement.

Named'em Tamed'em

Well-known member

If you use it for wages and the "correct" items you don't have to pay it back.so, say you grossed $60,000. It'd be 60,000 divided by 12= 5,000 5,000 x 2.5 = $12,500

And you don't have to pay it back?

10-e-c-dirtfarmer

Well-known member

Does anyone ever worry about their grandchildren having to pay all this free money back?

Buck Randall

Well-known member

- Joined

- Jun 5, 2019

- Messages

- 2,697

- Reaction score

- 3,148

No, because they won't. Government debt is very different from household debt.Does anyone ever worry about their grandchildren having to pay all this free money back?

sim.-ang.king

Well-known member

My banker called and told me I could get it, and how much. I told him, not interested, and my loan payment would be on time like always.

SBMF 2015

Well-known member

So I learned something today; after talking to 4 other farmers, my banker, my accountant, and my fsa lender. You qualify as an employee of your farm. You just have to pay yourself with the ppp money.TexasBred is right, it sounds like the PPP program. You have to have employees to qualify. If you prove it was used for payroll (and a couple of other things) and you don't lay off any workers, they will forgive the loan.

https://www.usda.gov/coronavirus/loans-and-grants

simme

Old Dumb Guy

I would encourage you to read and understand the rules prior to signing up. My daughter has a PPP loan from the first round. Her business is an LLC. She does not pay herself as an employee of the business. She just takes money out of the business account and moves it to her personal account as needed for her profit/compensation. The accounting method used does not treat her as an employee, but as the owner. Her conclusion for the first round of PPP was that the loan amount had to based on the payroll for her employees, not including herself. If she had been paying herself and treating herself as an employee, the loan amount (free money) could have been increased by 10 weeks of her pay. That was her understanding. It may have changed in these later rounds. Just be sure you understand the rules for your specific situation. There was much confusion on the first round and much paperwork for loan forgiveness. She submitted the paperwork. My understanding is that they are overwhelmed with the review of the first round forgiveness paperwork and are considering auto approval below certain size loans, but completed paperwork is required.

10-e-c-dirtfarmer

Well-known member

Can you explain that to me, in simple terms, because I sure would like to be enlightened.No, because they won't. Government debt is very different from household debt.

dirtfarmer, I was thinking the same thing. Does government debt not have to paid back. The interest on the debt does have to be paid - right?

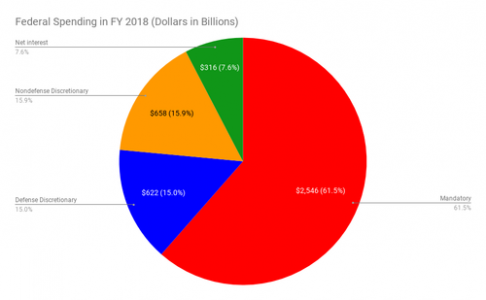

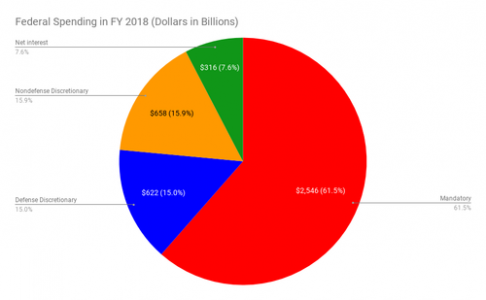

U.S interest payment on the debt is a now a large portion of the yearly budget and gets bigger or a greater percent of the budget every year.

debt spending

U.S interest payment on the debt is a now a large portion of the yearly budget and gets bigger or a greater percent of the budget every year.

debt spending

Buck Randall

Well-known member

- Joined

- Jun 5, 2019

- Messages

- 2,697

- Reaction score

- 3,148

In it's simplest terms, the government can essentially carry debt forever. I think this article sums it up nicely. The author is an economics professor at the University of Georgia.Can you explain that to me, in simple terms, because I sure would like to be enlightened.

Why the $22 trillion national debt doesn’t matter – here’s what you should worry about instead

Although US debt may be at eye-popping levels, an economist explains why it shouldn’t keep you up at night.

theconversation.com

theconversation.com

simme

Old Dumb Guy

Looks like then we should run the debt up to about 100 trillion. Everyone would be rich and apparently no concern for the future. Or maybe the professors don't know what they are doing and turning out misguided graduates.

If debt is not a problem for the government, then it looks like the government should buy and own everything and let the people just use it. Government would carry all debt, but no concern. People would carry no debt, but would have cars, houses, education, healthcare. Everything they needed. I think they tried that in the Soviet Union. Seems like they went bust. I think I am just too dumb in my old age to understand modern theory.

If debt is not a problem for the government, then it looks like the government should buy and own everything and let the people just use it. Government would carry all debt, but no concern. People would carry no debt, but would have cars, houses, education, healthcare. Everything they needed. I think they tried that in the Soviet Union. Seems like they went bust. I think I am just too dumb in my old age to understand modern theory.

SBMF 2015

Well-known member

During the '70's professors at the university of Illinois told students returning home to farm, that "They would never go broke borrowing money" . Then came the farm crisis of the '80's. Trade embargoes and inflation. A lot of those young farmers lost everything their families had worked generations to own.Or maybe the professors don't know what they are doing and turning out misguided graduates.

Similar threads

- Replies

- 4

- Views

- 682