Nesikep

Well-known member

Actually, a lot of people also hated Gamestop for some of their policies.. a joke on one of them I heard recently was "Your GME stocks must be returned in their original packaging" as a take on their policy that games had to be returned in original packaging to be worth anything.Sorry if this has already been said:

Gamestop is a "Brick and Mortar Store" that was one of the first to only sell video games and accessories. They were really big back in the 2000's- 2010's. With the advent of faster internet being more widely available, most video games are now downloaded directly to the machine rather than buying a physical game. So, there is less need for the brick and mortar storefront.

Gamestop is near and dear to the hearts of many that are now in their 30's and 40's because that is what they remember from their childhood.

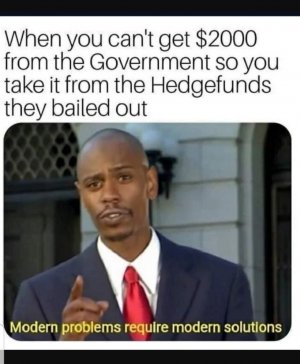

As to the Apps stopping the purchase of certain stocks, I understand why they did it. They are trying to protect the people that want to get in at the top of the bubble. I am not saying it is right, but I understand the rationale.

Edit: I just came from r/wallstreetbets (yes I am old and also a Redditor I am more popular there than I am here though). Nesi was right, those people see this as a moral cause and they do not mind losing. Today is the expiration day on a lot of GME options and they are dead set to hold their line and not take profits.

I also learned that one reason they are so angry is that GME could not open its doors due to the Pandemic and that the Hedge guys were taking full advantage to drive the stock into nothing. The folks on Reddit keep talking about saving 15k jobs that GME provides.

The reason you can't BUY stock is actually much more nuanced and goes way up the chain in the stock trade ladder.. I can't explain it very well but small brokers deal with big brokers that deal with a company called DTC which essentially guarantees the money used from the brokers is actually there. Depending on who your broker was you still could buy stock if they traded directly with DTC, but the requirements to buy had changed, previously 1%, then 5, then 10%, and finally 100% of the money had to be paid in order to buy and they couldn't guarantee that much.

This goes into it more