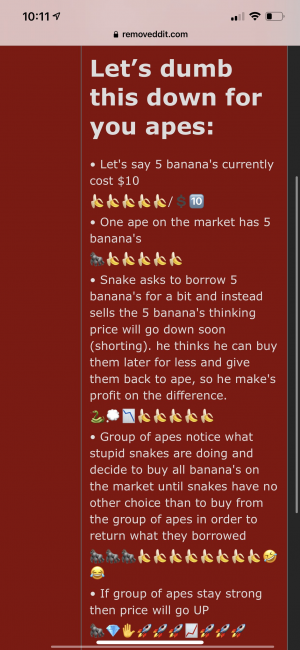

The Hedge Funds were shorting Gamestop. Someone noticed that about 70-80% of the stock was shorted by the Funds (driving the price of the stock artificially low to make a profit on it). A bunch of people on Reddit decided to drive the price of the stock up.

The result was that the Hedge Funds were caught in a short squeeze and they had to deliver on their options. The result was price-skyrocket and Hedge Funds losing tons to cover their losses. I wish I was that smart.

Those wall street folks are all gamers! Some financial and conservative media is outraged, but the little guys were just doing what the insiders have done for years. I do know one Fund had to go borrow money quickly to cover the (big) losses.

For the little guy, never trade on leverage! It will eventually come back to bite you!