I planted bean seed last year from the freezer that had 2003 on the bag and corn 2009. I believe every seed sprouted. I have a pretty large garbage bag of seed on hand in the freezer. I am good to go. I have enough canned goods left over if the SHTF I could hold out till next garden.I wonder if all of the self sufficent folks planting a garden saved seeds from last years crop or except to go online and buy the lastest and greatest hybrid vegetable. Just wondering

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation and spending habits

- Thread starter Lucky

- Start date

Help Support CattleToday:

Dave

Well-known member

Very true but there are some gambles that you prefer not to take twice or three times. And some gambles you will take over and over. One of the great things in this life is you get to choose your gambles.Life is a gamble any way you look at it.

D2Cat

Well-known member

Very true but there are some gambles that you prefer not to take twice or three times. And some gambles you will take over and over. One of the great things in this life is you get to choose your gambles.

Sometimes, sometimes not!

Little Joe

Well-known member

If you listen to most investment type gurus like Dave Ramsey they say investing in single stocks is a bad decision unless you can afford to lose the money, instead you should invest in good mutual funds which hold hundreds of stocks under one fund. The idea is if one single stock is tanking another in another sector is probably doing good. They also suggest diversity amongst your mutual funds. Anything that makes money is a risk but mutual funds buffer that risk a little. You won't see the highs with mutual funds like you may with single stocks but also won't see the lows. While Trump was in and last year I averaged 20-25% on funds.You could also lose your shirt. My sister quit a great corporate job with a big clothing retailer to go to work for a dot com outfit. I invested in their stock. The dot com bust came along and I lost every penny I invested. Had a lot of money in Washington Mutual. Not deposit but company stock. A very solid old banking company. They went down and took all my money down the drain with them. People certainly make money playing the stocks but they are and always have been a gamble.

Little Joe

Well-known member

We're always talking on here about how leveraged most Americans are, I seen a perfect example yesterday. I had a guy reach out to me a while back about a job, I have an opening now so I called him in to talk with me. He currently drives approximately 50 miles one way to work, I'm 12 miles one way from his house. He was 100% on board until I told him we only get paid once a month, he said he has bills due all month and couldn't make it from his last pay check at his current job to his first check with us. He and his wife are in their forties, she recently found out she has cancer and no longer can work. Both just had jobs, not a career path. He went on to explain how strapped he was financially and that he might have to sell his work van that he uses to make side money, the van is paid for. On the other hand his new crew cab 4x4 ford ranger is not and his wife's new ford bronco is not, I told him it sounds like the bronco needs to go since she isn't working anymore, his reply was " but the bronco is new".

I have considered trying to help them out but until he stops the bleed, my help won't even be a good band-aid. It's a sinking ship and they don't even realize it. The change in jobs would save him close to $100/week just in gas besides all the mileage on a vehicle. It's hard to watch people struggle with something that they could control if they just would.

I have considered trying to help them out but until he stops the bleed, my help won't even be a good band-aid. It's a sinking ship and they don't even realize it. The change in jobs would save him close to $100/week just in gas besides all the mileage on a vehicle. It's hard to watch people struggle with something that they could control if they just would.

SmokinM

Well-known member

Can't help those that wont help themselves plain and simple.We're always talking on here about how leveraged most Americans are, I seen a perfect example yesterday. I had a guy reach out to me a while back about a job, I have an opening now so I called him in to talk with me. He currently drives approximately 50 miles one way to work, I'm 12 miles one way from his house. He was 100% on board until I told him we only get paid once a month, he said he has bills due all month and couldn't make it from his last pay check at his current job to his first check with us. He and his wife are in their forties, she recently found out she has cancer and no longer can work. Both just had jobs, not a career path. He went on to explain how strapped he was financially and that he might have to sell his work van that he uses to make side money, the van is paid for. On the other hand his new crew cab 4x4 ford ranger is not and his wife's new ford bronco is not, I told him it sounds like the bronco needs to go since she isn't working anymore, his reply was " but the bronco is new".

I have considered trying to help them out but until he stops the bleed, my help won't even be a good band-aid. It's a sinking ship and they don't even realize it. The change in jobs would save him close to $100/week just in gas besides all the mileage on a vehicle. It's hard to watch people struggle with something that they could control if they just would.

D2Cat

Well-known member

I know a respectable couple who declared they promised each other early in their marriage they would always have a car payment. I explained to him how stupid that was, but it had no effect on their actions.

I was taught (and learned) early on life, "When your outgo exceeds your income, your upkeep becomes your downfall."

I was taught (and learned) early on life, "When your outgo exceeds your income, your upkeep becomes your downfall."

Dave

Well-known member

Both of those times I also had money in mutual funds. I lost value there too at those times. I didn't lose it all as I did in single stocks It took a few years to get back to even. I got burned bad enough that I decided the stock market wasn't for me.If you listen to most investment type gurus like Dave Ramsey they say investing in single stocks is a bad decision unless you can afford to lose the money, instead you should invest in good mutual funds which hold hundreds of stocks under one fund. The idea is if one single stock is tanking another in another sector is probably doing good. They also suggest diversity amongst your mutual funds. Anything that makes money is a risk but mutual funds buffer that risk a little. You won't see the highs with mutual funds like you may with single stocks but also won't see the lows. While Trump was in and last year I averaged 20-25% on funds.

greybeard

Well-known member

I know a respectable couple who declared they promised each other early in their marriage they would always have a car payment.

Ya know, as I read that, I just can't see it as something I'd ever be a part of.

Yes, promise to always be faithful, promise to always love. Promise to always be there for each other, thru thick and thin.

But promise to always have a car payment? Seems kinda trite and shallow..

Last edited:

My 401K is 1/2 index funds and 1/2 individual stocks that I manage. Both accounts perform about the same but I spend more time on the individual stocks that I manage. Might as well just have the index funds and be done with it but I can't stop tinkering.Both of those times I also had money in mutual funds. I lost value there too at those times. I didn't lose it all as I did in single stocks It took a few years to get back to even. I got burned bad enough that I decided the stock market wasn't for me.

Little Joe

Well-known member

That would be in the list of some of the dumbest things I've ever heard. My wife and I promised to try our best to never have another car payment, that's about as close as I've ever been to driving down the highway and throwing out money as I went.I know a respectable couple who declared they promised each other early in their marriage they would always have a car payment. I explained to him how stupid that was, but it had no effect on their actions.

I was taught (and learned) early on life, "When your outgo exceeds your income, your upkeep becomes your downfall."

The gentleman I spoke to yesterday about the job was astonished when I told him my truck has 250k miles and my wife's Tahoe has 270k, he acted like he'd never heard of people driving a vehicle that long. I like buying assets, not liabilities.

hurleyjd

Well-known member

I wonder if all of the self sufficent folks planting a garden saved seeds from last years crop or except to go online and buy the lastest and greatest hybrid vegetable. Just wondering

Life is a gamble any way you look at it.

I started in the work force in 1962. $1.65 per hour. Car prices new were in the $1100 to $1200 range for a suitable car for what you bought a car for. Payments on a 36 monthly payments would be around $30 more and less. I was easier for my wife and me to buy a new car than to put tires on the car when due. Might add another $1.50 a month on the new car.Maintenance is cheaper then a car payment.

D2Cat

Well-known member

Ya know, as I read that, I just can't see it as something I'd ever be a part of.

Yes, promise to always be faithful, promise to always love. Promise to always be there for each other, thru thick and thin.

But promise to always have a car payment? Seems kinda trite and shallow..

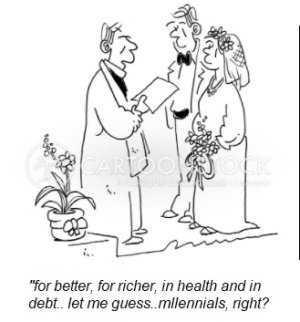

View attachment 14388

View attachment 14389

I agree. And a couple years later he asked me, "How much should a person with a college degree and two kids earn?"

I asked him what does one have to do with the other, and he had no answer.

You'd probably be surprised what his occupation was, but I won't say to save them from embarrassment.

Dad farmed for years on the family farm on a CASH basis. Then he went to Buy the farm off his father and went to the bank to get a LOAN!

They said he had NO CREDIT RATING --- even though he had a LOT of MONEY in their bank!

He scowled at the president of the bank and said "I've farmed for 40 years without borrowing a cent and raised a family -- and you think I have no RATING!"

When told them to hand him ALL of his money in his accounts in a BAG and he'd go elsewhere!!!

They loaned him the money!

They said he had NO CREDIT RATING --- even though he had a LOT of MONEY in their bank!

He scowled at the president of the bank and said "I've farmed for 40 years without borrowing a cent and raised a family -- and you think I have no RATING!"

When told them to hand him ALL of his money in his accounts in a BAG and he'd go elsewhere!!!

They loaned him the money!

Caustic Burno

Well-known member

Y'all might be fixing to find out why my mom washed aluminum foil and only went to the store for staples.

Ebenezer

Well-known member

The bank wants you to trust them with your money on faith and they only let you use the good ink pen if it is chained to the desk!Dad farmed for years on the family farm on a CASH basis. Then he went to Buy the farm off his father and went to the bank to get a LOAN!

They said he had NO CREDIT RATING --- even though he had a LOT of MONEY in their bank!

He scowled at the president of the bank and said "I've farmed for 40 years without borrowing a cent and raised a family -- and you think I have no RATING!"

When told them to hand him ALL of his money in his accounts in a BAG and he'd go elsewhere!!!

They loaned him the money!

Dad farmed for years on the family farm on a CASH basis. Then he went to Buy the farm off his father and went to the bank to get a LOAN!

They said he had NO CREDIT RATING --- even though he had a LOT of MONEY in their bank!

He scowled at the president of the bank and said "I've farmed for 40 years without borrowing a cent and raised a family -- and you think I have no RATING!"

When told them to hand him ALL of his money in his accounts in a BAG and he'd go elsewhere!!!

They loaned him the money!

He was very wise. Most people get suckered by so called professionals. There are whole business models built off of customers' ignorance.

callmefence

Keyboard cowboy

There's no doubt. Some folks are to slow to understand how it works. Some lack the skills to invest in themselves. Those people do indeed need to stick to cash and invest in other people's success.

Stocker Steve

Well-known member

Some couples always have two car payments...I know a respectable couple who declared they promised each other early in their marriage they would always have a car payment. I explained to him how stupid that was, but it had no effect on their actions.

Similar threads

- Replies

- 30

- Views

- 1K