You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Property Tax Increases

- Thread starter Mountaintown Creek Ranch

- Start date

Help Support CattleToday:

4hfarms

Well-known member

Mine went up but nothing like that! They raised the property value to tax us more. Read that we will be taxed out of our homes soon enough If this continues.

I believe approx 70% of ours goes to schools. However as soon as I am 65 we don't have to pay tax for school district.Our taxes in Texas have been going up also. In our area over 50% of the property taxes go to the school system and nobody throws money away faster than the public school system.

puzzled in oregon

Well-known member

- Joined

- May 31, 2020

- Messages

- 829

- Reaction score

- 1,097

Will they actually lower your taxes, or just allocate the school funds to other departments?

I think 70-75 percent of my property tax goes to schools. We get no break, they tax us as long as we are breathing.

I think 70-75 percent of my property tax goes to schools. We get no break, they tax us as long as we are breathing.

Ky hills

Well-known member

There is usually an appeal process if you are not happy with your property assessment.

My tax bill on 1900ac with house and yard is $6000 more reasonable than I thought after seeing what others are paying.

My tax bill on 1900ac with house and yard is $6000 more reasonable than I thought after seeing what others are paying.

Travlr

Well-known member

Have 11 acres that I cleared and turned into pasture.

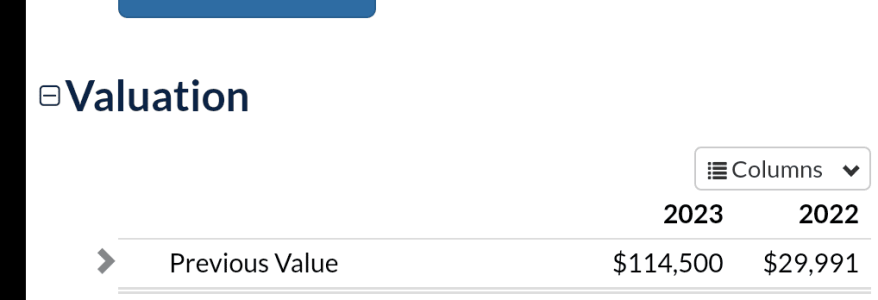

Value went from $29,000 to $114,000

We have +/- 250 acres = $13,000 taxes.

Our tax went up over 100% on some tracts that are just deep woods.

Real estate market still hot in this area of the mountains.

View attachment 38048

I'd be considering lodging a dispute on that tax rise with the eleven acres. It's agricultural land, isn't it? Not something being developed for a subdivision or some other kind of improved use?

The taxes and insurance on real estate is crazy. I expect that a lot of fixed income people that have worked all their lives and set themselves up for an easy retirement are now pulling their hair out. Even with a paid for home the taxes and insurance are getting to the point that they are as high as payment when the real estate was being financed.

And of course social security isn't ever going to fill those gaps.

I just got it rezoned agricultural in May. Hoping taxes go down.I'd be considering lodging a dispute on that tax rise with the eleven acres. It's agricultural land, isn't it? Not something being developed for a subdivision or some other kind of improved use?

The taxes and insurance on real estate is crazy. I expect that a lot of fixed income people that have worked all their lives and set themselves up for an easy retirement are now pulling their hair out. Even with a paid for home the taxes and insurance are getting to the point that they are as high as payment when the real estate was being financed.

And of course social security isn't ever going to fill those gaps.

Ky hills

Well-known member

On the subject of insurance, our homeowners/property insurance has gone up over $500 on our recent bill, and my health insurance jumped up significantly more too recently.I'd be considering lodging a dispute on that tax rise with the eleven acres. It's agricultural land, isn't it? Not something being developed for a subdivision or some other kind of improved use?

The taxes and insurance on real estate is crazy. I expect that a lot of fixed income people that have worked all their lives and set themselves up for an easy retirement are now pulling their hair out. Even with a paid for home the taxes and insurance are getting to the point that they are as high as payment when the real estate was being financed.

And of course social security isn't ever going to fill those gaps.

Travlr

Well-known member

That's what happens when the money supply is increased to "give" us those stimulus checks.On the subject of insurance, our homeowners/property insurance has gone up over $500 on our recent bill, and my health insurance jumped up significantly more too recently.

Well worth it in our experience. Disputed taxes on oil royalties a few years ago and our taxes were significantly reduced. Yeah, they just estimate in advance what it will be, as opposed to how many barrels were actually produced. It's cyclical. And we disputed the back 40 that is used strictly for hunting because there is no direct access by road. Last year the state decided to slap a hefty personal property tax on all UTV's - unless you appeal and have it approved that any UTV you own is strictly for farm/ranch. Which we did, and actually got a refund for the tax we already paid. Plus, they added a permanent exemption in our files, so we don't have to deal with that every year.I'd be considering lodging a dispute

greybeard

Well-known member

Have 11 acres that I cleared and turned into pasture.

Value went from $29,000 to $114,000

We have +/- 250 acres = $13,000 taxes.

Our tax went up over 100% on some tracts that are just deep woods.

Real estate market still hot in this area of the mountains.

View attachment 38048

So, you are saying (that the taxing or appraising entity is saying) that your property VALUE increased substantially and it is now taxed accordingly?

Mrcopier

Well-known member

In Texas they can't go up more than 10% in a calendar year. I believe I would challenge thatHave 11 acres that I cleared and turned into pasture.

Value went from $29,000 to $114,000

We have +/- 250 acres = $13,000 taxes.

Our tax went up over 100% on some tracts that are just deep woods.

Real estate market still hot in this area of the mountains.

View attachment 38048

When I read these threads I'm glad I live in Texas.

I hear Texas has money left over I guess they know how to balance a budget !

Someone told me California has 68 billion dollars deficit

Newsome is awesome

Newsome is awesome

Someone told me California has 68 billion dollars deficit

It's amazing to me what things cost these days. I'd say a job paying 100k 4 yrs ago is worth 60k today. Not sure how people are still getting buy. I never go to a store that isn't packed or a drive through that doesn't have a line though.

Dave

Well-known member

I wont complain about my property taxes after reading this. I have 1,200+ acres, house, barn, over sized garage, and shop. My taxes are about $3,300 a year.

Caustic Burno

Well-known member

Yep we voted in property tax reduction they just raised the evaluation to get it back.Our taxes in Texas have been going up also. In our area over 50% of the property taxes go to the school system and nobody throws money away faster than the public school system.

We need to go to straight sales tax.

Get every illegal along with all that public housing bunch driving Cadillac Escalades.