greybeard

Well-known member

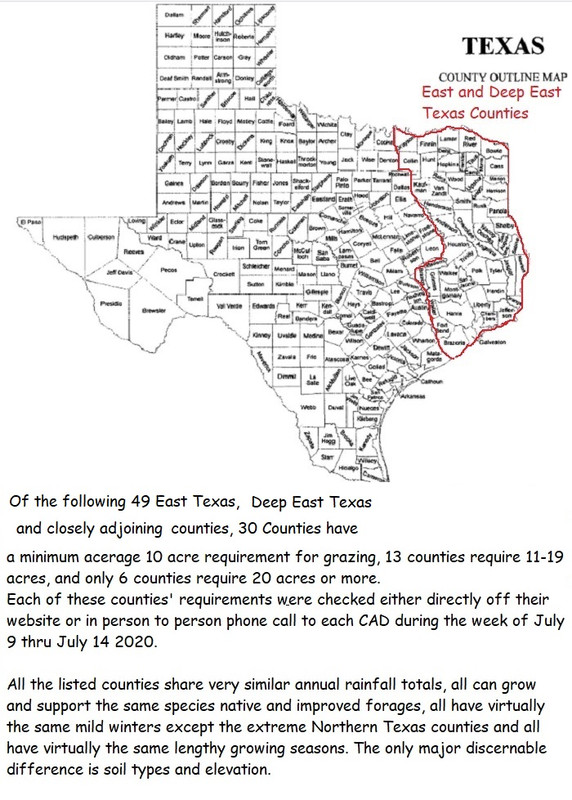

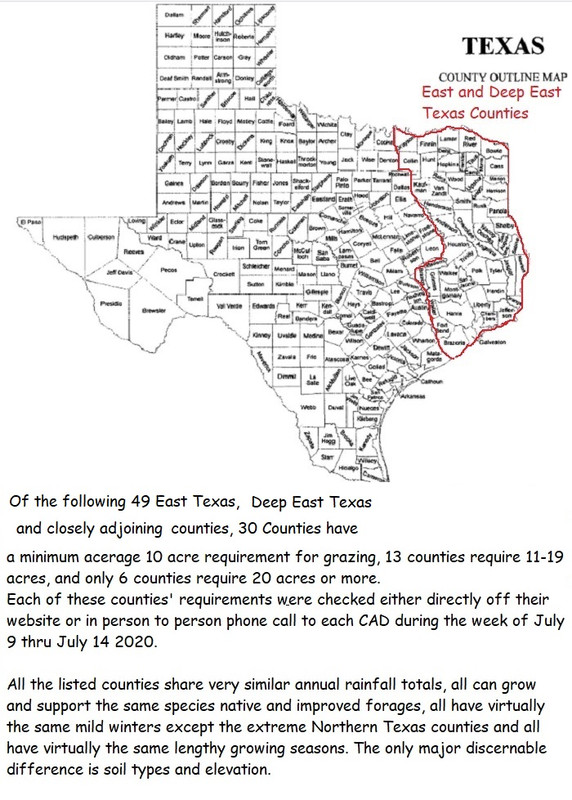

This is what it is. Every entry is accurate only to the extent that the individual county's website was or if website didn't include the requirements for 1d1, then it depends how informed the Central Appraisal District's person on the other end of the phone line was.

If you are fairly sure your county's data is wrong, LMK and I will call them back and update the list if the county confirms it.

(2 counties are omitted..one did not return the call and the other's website was down..Lamar and Red River)

(I did not include requirements for timber exemption nor will I. I usually did not inquire about livestock other than cattle either, as I made the list for a specific reason regarding cattle.)

EAST AND DEEP EAST TEXAS AG GUIDELINES

ANDERSON County:

Improved Pasture¹: Includes but not limited to pasture that is mowed, shredded, fertilized, cultivated, seeded, and planted with grasses. (fence and livestock required)

Unimproved Pasture¹: Pasture with native grasses, and has none of the above completed, could have less than 30 trees per acre. (Fence and livestock required)

WOODED Pasture² asture that has less than 200 trees per acre. Must have sufficient forage base to sustain livestock to qualify! (fence and livestock required)

asture that has less than 200 trees per acre. Must have sufficient forage base to sustain livestock to qualify! (fence and livestock required)

¹ Open pasture should have a minimum of one(1) head of livestock per 3 acres.

(15 acres and less requires a minimum of FIVE (5) head of livestock)

²Wooded Pasture should have a minimum of one(1) head livestock per 5 acre. Wooded pasture must have sufficient forage base to sustain livestock to qualify.

(25 acres and less requires a minimum of five (5) head of livestock)

SAN JACINTO County.

20 acres is required with 75% of the tract cleared open space for grazing. At Least 6 head of reproducing cows, with tracts larger than 20 ac having 1 additional cow to every 1-15 acres.

A minimum of approximately 20 acres is required.

At least 75% open for grazing with no more than 25% wooded.

8au 1st 20-40 acres, 1 cow for each additional 5 acres.

5 acres for hay production.

TYLER County

10-20 acres good to average pasture with intensity on a case by case basis.

5-10 acres for hay.

POLK County

Minimum 10 acres for hay and 15 acres for cattle grazing with approx 2au/7ac but case by case basis.

LIBERTY County

NATIVE Pasture.

15ac -20ac minimum 1 au per 7 ac.. WITH A MINIMUM OF

5 ANIMAL UNITS.

Improved Pasture. 10 acres required. 1 au per 3 ac.

Hay=10 ac required with 2 cuttings/year .

TRINITY County

1)Cattle Smaller size tracts will be reviewed on a case by case basis.

2) At least 75% open to grazing with no more than 25% wooded.

3) At least five (5) head of mother cows.

4) Larger tracts should have one (1) cow to every five(5) ac.

HARDIN County

10 acres. Improved pasture= 1 au/3acres. Native pasture= 1au/5AC with at least 3 total.

SAN AUGUSTINE County.

10acres both native and improved. Case by case basis for intensity.

5ac for hay.

NACOGDOCHES County.

20 ac with 6AU.

10Ac Hay.

HARRIS County.

Improved Pasture-7 acs required, Minimum of four (4) au. Must have one (1) animal unit per 4 acs on larger tracts.

Native Pasture-8 acres required. must produce sufficient forage to sustain a minimum of 4 animal units. Minimum of four (4) au. Must have one (1) animal unit per 7 acs on larger tracts.

Hay 7 acres with 2400 lbs each cutting.

Cow/Calf Improved Pasture................15........................................... 1 unit to 3 acres.

Hay..10 ac 2-3 cuttings/yr.

GRIMES County

not less than 10 acres.

5 animal units (1 cow = 1AU) for small tracts

Minimum stocking rates for larger tracts: improved pasture, one cow to 5 acres; native pasture, one cow to 10 acres; woods and brush, one cow to

20 acres.

Hay 10 acres with 2-3 cuttings of approx 6000lbs/ac/yr on improved land.

WALKER County.

10 acres intesity will vary for both native and improved pasture.

5 acres minum for hay.

NEWTON County.

Improved pasture=5ac with 3au.

Native pasture=5ac with 3au

JASPER County

10 ac and will accept less if managed intensively. 3 mommas/10ac.

Hay 5 acres.

ORANGE County

Native..15 Acre 1 animal unit per 5 acres with a

minimum of 3 animal units

Improved..Same as Native except 1 animal per 3 acres.

SHELBY County.

Grazing is case by case basis.

Hay-4ac

row crop 4 ac/truck produce 4 ac.

HOUSTON County

10 acres. 3-5 momma cows per 10 acres. My be used in coinjucntion with off site pasture.

CHEROKEE County.

Small acerage not ok for cow/calf but ok for backgrounding yearlings. Hay 7 acres.

Cow/Calf-15-20 ac min.

RUSK County.

16 acres with 4 cows 1 bull or 16 calves.

5acres for hay.

MARION County.

10 acres with 3 au. 5 acres for hay.

RAINS County.

5 acres grazing with 1AU. or 5 acres hay.

HOPKINS County

20acres with 1au/4ac. Hay=10 ac.

GREGG County.

16 acres for grazing..improved pasture.

20 acres native.

Hay=5 acres with max 20 acres.

FANNIN County.

Native and improved 10 acres with 2au/5ac. Hay 10ac with 2000lb from native and 4000 from Improved.

PANOLA County.

10 ac with 1 cow per 2 acres. 10 acres=hay.

SABINE County.

10 acres grazing and or hay. 2au/5 acres.

UPSHUR County.

3 acre min-1AU per 3 ac. Hay 5 acres and must retain reciepts current year.

VAN ZANDT County.

10 ac with 1au per 5 acres. Hay 10 acres.Goats 5acres.

DELTA County.

5 acre minimum with 1 au/3acres. Hay 5 acres-4000lbs per acre.

FRANKLIN County.

10 ac with 5 hd/10 acres. Hay 5 acres.

WOOD County.

5 acres. 1au/5acres. Hay 5 acres and 2 cuttings.

MORRIS County.

5 acres hay or grazing no min AU or tonnage.

CASS County.

8 acres-1 au/4 acres. Hay 5 acres.

KAUFMAN County.

9 acres. 4au + 1 cow for each additional 5-8 acres. Hay 9ac min, should be fertilized ea yr.

CAMP County

5 acres min. 1au.

Hay 5ac.

HENDERSON County.

10 acres @ 2au. Hay-10 acres.

BOWIE County.

Cattle and Hay-7 acres. 2au/7 ac.

BRAZOS County.

Min 15 acres native or improved. Min 5au cattle, Hogs 5 ac. Hay 8 ac.

FREESTONE County.

minimum 5-7 ac for improved and 7-2 for native pasture. 5 ac for hay. 1-2 rounds or 20-40 sq/acre 2 cuttings/yr.

GRAYSON County.

15 ac improved with 3au/5 ac=5 cow minimum.

Native-1au/7 acres. 35 acres minimum. 5 cow minimum.

WALLER County.

Pasture Land Native** Minimum 15ac. Must have one(1) animal unit * per 7 acres with a minimum of 5 animal units

Improved*** Minimum of 10ac. Must have one(1) animal unit * per 5 acres with a

minimum of 5 animal units

Wooded Minimum of 20ac. Ratio depends on density of woods; One (1)

animal unit per 10‐12 acres.

CHAMBERS County

3ac min Improved pasture with 1au or 2 cuts hay/yr.

6ac min Native pasture with 1au.

HUNT County.

Degree of Intensity in acreage

For purposes other than beekeeping, which has its own acreage requirements

specified by law, a degree of intensity of 3 ACRES will be required to distinguish

Qualifying Agriculture Tracts from Hobby operations. This is a guideline only and

any application for agriculture valuation below 3 acres will be considered on a

case by case basis. One such consideration would be an application for a tract

of land used with other qualified agricultural property being owned by the same

person(s) or family member.

PASTURE:

MINIMUM # OF HEAD

PER 5 ACRES

Cattle Adult Cows or Bulls = 1au/5 acres

BRAZORIA County.

Improved pasture 9 ac required with min of 3au.

Native pasture 15 ac with min of 3 au.

FORT BEND County

Improved pasture cattle and Hay production:

1 AU per 5Ac or 2 tons hay/ac.

Minimum of 5AU with 25 acre minimum.

Native Pasture:

1AU per 8 ac.

Minimum of 5AU with 40 ac minimum.

JEFFERSON County

10ac with 3AU. Smaller parcels will qualify if hay is also cut.

SMITH County

5 acres minimum with 2au for grazing and/or hay.

If you are fairly sure your county's data is wrong, LMK and I will call them back and update the list if the county confirms it.

(2 counties are omitted..one did not return the call and the other's website was down..Lamar and Red River)

(I did not include requirements for timber exemption nor will I. I usually did not inquire about livestock other than cattle either, as I made the list for a specific reason regarding cattle.)

EAST AND DEEP EAST TEXAS AG GUIDELINES

ANDERSON County:

Improved Pasture¹: Includes but not limited to pasture that is mowed, shredded, fertilized, cultivated, seeded, and planted with grasses. (fence and livestock required)

Unimproved Pasture¹: Pasture with native grasses, and has none of the above completed, could have less than 30 trees per acre. (Fence and livestock required)

WOODED Pasture²

¹ Open pasture should have a minimum of one(1) head of livestock per 3 acres.

(15 acres and less requires a minimum of FIVE (5) head of livestock)

²Wooded Pasture should have a minimum of one(1) head livestock per 5 acre. Wooded pasture must have sufficient forage base to sustain livestock to qualify.

(25 acres and less requires a minimum of five (5) head of livestock)

SAN JACINTO County.

20 acres is required with 75% of the tract cleared open space for grazing. At Least 6 head of reproducing cows, with tracts larger than 20 ac having 1 additional cow to every 1-15 acres.

A minimum of approximately 20 acres is required.

At least 75% open for grazing with no more than 25% wooded.

8au 1st 20-40 acres, 1 cow for each additional 5 acres.

5 acres for hay production.

TYLER County

10-20 acres good to average pasture with intensity on a case by case basis.

5-10 acres for hay.

POLK County

Minimum 10 acres for hay and 15 acres for cattle grazing with approx 2au/7ac but case by case basis.

LIBERTY County

NATIVE Pasture.

15ac -20ac minimum 1 au per 7 ac.. WITH A MINIMUM OF

5 ANIMAL UNITS.

Improved Pasture. 10 acres required. 1 au per 3 ac.

Hay=10 ac required with 2 cuttings/year .

TRINITY County

1)Cattle Smaller size tracts will be reviewed on a case by case basis.

2) At least 75% open to grazing with no more than 25% wooded.

3) At least five (5) head of mother cows.

4) Larger tracts should have one (1) cow to every five(5) ac.

HARDIN County

10 acres. Improved pasture= 1 au/3acres. Native pasture= 1au/5AC with at least 3 total.

SAN AUGUSTINE County.

10acres both native and improved. Case by case basis for intensity.

5ac for hay.

NACOGDOCHES County.

20 ac with 6AU.

10Ac Hay.

HARRIS County.

Improved Pasture-7 acs required, Minimum of four (4) au. Must have one (1) animal unit per 4 acs on larger tracts.

Native Pasture-8 acres required. must produce sufficient forage to sustain a minimum of 4 animal units. Minimum of four (4) au. Must have one (1) animal unit per 7 acs on larger tracts.

Hay 7 acres with 2400 lbs each cutting.

Cow/Calf Native Pasture ...................20........................................... 1 unit to 5 acresANGELINA County

Cow/Calf Improved Pasture................15........................................... 1 unit to 3 acres.

Hay..10 ac 2-3 cuttings/yr.

GRIMES County

not less than 10 acres.

5 animal units (1 cow = 1AU) for small tracts

Minimum stocking rates for larger tracts: improved pasture, one cow to 5 acres; native pasture, one cow to 10 acres; woods and brush, one cow to

20 acres.

Hay 10 acres with 2-3 cuttings of approx 6000lbs/ac/yr on improved land.

WALKER County.

10 acres intesity will vary for both native and improved pasture.

5 acres minum for hay.

NEWTON County.

Improved pasture=5ac with 3au.

Native pasture=5ac with 3au

JASPER County

10 ac and will accept less if managed intensively. 3 mommas/10ac.

Hay 5 acres.

ORANGE County

Native..15 Acre 1 animal unit per 5 acres with a

minimum of 3 animal units

Improved..Same as Native except 1 animal per 3 acres.

SHELBY County.

Grazing is case by case basis.

Hay-4ac

row crop 4 ac/truck produce 4 ac.

HOUSTON County

10 acres. 3-5 momma cows per 10 acres. My be used in coinjucntion with off site pasture.

CHEROKEE County.

Small acerage not ok for cow/calf but ok for backgrounding yearlings. Hay 7 acres.

Cow/Calf-15-20 ac min.

RUSK County.

16 acres with 4 cows 1 bull or 16 calves.

5acres for hay.

MARION County.

10 acres with 3 au. 5 acres for hay.

RAINS County.

5 acres grazing with 1AU. or 5 acres hay.

HOPKINS County

20acres with 1au/4ac. Hay=10 ac.

GREGG County.

16 acres for grazing..improved pasture.

20 acres native.

Hay=5 acres with max 20 acres.

FANNIN County.

Native and improved 10 acres with 2au/5ac. Hay 10ac with 2000lb from native and 4000 from Improved.

PANOLA County.

10 ac with 1 cow per 2 acres. 10 acres=hay.

SABINE County.

10 acres grazing and or hay. 2au/5 acres.

UPSHUR County.

3 acre min-1AU per 3 ac. Hay 5 acres and must retain reciepts current year.

VAN ZANDT County.

10 ac with 1au per 5 acres. Hay 10 acres.Goats 5acres.

DELTA County.

5 acre minimum with 1 au/3acres. Hay 5 acres-4000lbs per acre.

FRANKLIN County.

10 ac with 5 hd/10 acres. Hay 5 acres.

WOOD County.

5 acres. 1au/5acres. Hay 5 acres and 2 cuttings.

MORRIS County.

5 acres hay or grazing no min AU or tonnage.

CASS County.

8 acres-1 au/4 acres. Hay 5 acres.

KAUFMAN County.

9 acres. 4au + 1 cow for each additional 5-8 acres. Hay 9ac min, should be fertilized ea yr.

CAMP County

5 acres min. 1au.

Hay 5ac.

HENDERSON County.

10 acres @ 2au. Hay-10 acres.

BOWIE County.

Cattle and Hay-7 acres. 2au/7 ac.

BRAZOS County.

Min 15 acres native or improved. Min 5au cattle, Hogs 5 ac. Hay 8 ac.

FREESTONE County.

minimum 5-7 ac for improved and 7-2 for native pasture. 5 ac for hay. 1-2 rounds or 20-40 sq/acre 2 cuttings/yr.

GRAYSON County.

15 ac improved with 3au/5 ac=5 cow minimum.

Native-1au/7 acres. 35 acres minimum. 5 cow minimum.

WALLER County.

Pasture Land Native** Minimum 15ac. Must have one(1) animal unit * per 7 acres with a minimum of 5 animal units

Improved*** Minimum of 10ac. Must have one(1) animal unit * per 5 acres with a

minimum of 5 animal units

Wooded Minimum of 20ac. Ratio depends on density of woods; One (1)

animal unit per 10‐12 acres.

CHAMBERS County

3ac min Improved pasture with 1au or 2 cuts hay/yr.

6ac min Native pasture with 1au.

HUNT County.

Degree of Intensity in acreage

For purposes other than beekeeping, which has its own acreage requirements

specified by law, a degree of intensity of 3 ACRES will be required to distinguish

Qualifying Agriculture Tracts from Hobby operations. This is a guideline only and

any application for agriculture valuation below 3 acres will be considered on a

case by case basis. One such consideration would be an application for a tract

of land used with other qualified agricultural property being owned by the same

person(s) or family member.

PASTURE:

MINIMUM # OF HEAD

PER 5 ACRES

Cattle Adult Cows or Bulls = 1au/5 acres

BRAZORIA County.

Improved pasture 9 ac required with min of 3au.

Native pasture 15 ac with min of 3 au.

FORT BEND County

Improved pasture cattle and Hay production:

1 AU per 5Ac or 2 tons hay/ac.

Minimum of 5AU with 25 acre minimum.

Native Pasture:

1AU per 8 ac.

Minimum of 5AU with 40 ac minimum.

JEFFERSON County

10ac with 3AU. Smaller parcels will qualify if hay is also cut.

SMITH County

5 acres minimum with 2au for grazing and/or hay.