TerraceRidge

Active member

I've been seeing a lot of discussion recently about packer gross profit. Believe me, I have no great love for the packers, and I would much rather the American farmer/rancher make money than the packers. But if we're going to claim that they are taking advantage of cattle producers, we have to be right.

Here is an example of a Facebook post that I saw last night and that expresses a common sentiment (copied word for word):

"ATTENTION MEAT CONSUMERS....... As the packers continue to raise box beef prices to ridiculous prices spreads I would like to point out a few details. Right now with their box beef prices they are selling, it makess average fat cattle worth $235.71 per hundred weight in the meat. Translate that to what cash fat cattle should be worth is approximately 63.5% of the hanging weight. $235.72×63.5%= $149.67 per hundred weight is what cash fat cattle should be worth at that high of box beef prices. The average fat cattle prices this week have been $1.05 to $1.10. The packers are also getting a drop credit value at $107.72 of those cattle. If you take $149.76 what they should be worth -$110.00(at best)= $39.76 per hundred price difference. So if their butchering cattle weighing a average of 1,400lbs you take 14×$39.76=$556.64 profit to the packers. Wait you forgot to ad their bonus onto that! $107.72+$556.64= $664.36 PROFIT TO THE PACKERS!!!!!!! the farmers are LOSING $350 per head and the packers are PROFITING $664.36 per head. They are doing this with a smile everytime you go buy meat and sell cattle. Think about that for a minute."

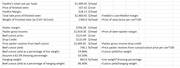

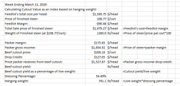

But that math looks completely wrong. Assume fat cattle are $110/cwt, and assume a 63.5% dressing percentage. That makes cattle worth $173/cwt based on hanging weight. Then assume a beef cutout yield of 70%. That makes the boxed beef worth $247/cwt.

Now consider a 1400 lb finished steer with a hanging weight of 889 lb. Assume he has a yield grade of 3-4. He should yield about 70% of his hanging weight in retail cuts according to Oklahoma State University (http://4h.okstate.edu/literature-links/lit-online/animal-science-companion-animals/copy_of_beef/N-614_web.pdf/). Therefore, if our steer produces 622.3 lb of retail cuts and sells them at the price quoted in that Facebook post ($235.71), then the steer is worth $1466.82, or $104.8/cwt. The packer just lost $72.80 on that animal before the drop credit is factored in. According to the Facebook post, if the drop credit is $107.72, the packer gross profit per animal is $34.92. I frankly don't know how they're able to stay open at that price.

For the sake of discussion, here is a market report that we can use just so we're all on the same page: https://www.ams.usda.gov/mnreports/lm_xb402.txt

Here is a market report for drop credits, and it seems to be fairly in line with what was quoted in the Facebook post. The price is estimated at $7.57/cwt live weight: https://www.ams.usda.gov/mnreports/nw_ls444.txt

That is interesting, because the drop credit in 2013 was twice as much: https://www.roundupweb.com/story/2013/03/06/opinion/drop-credit-what-is-it/2230.html

This source summarizes what I'm saying:

https://beef-cattle.extension.org/what-does-the-phrase-drop-credit-refer-to/

Based on these numbers, the packing plants don't seem to be taking advantage of cattle producers at all. Can anybody challenge these numbers? I would like to be able to blame the packers for low prices as much as the next guy, but we have to use honest math.

Here is an example of a Facebook post that I saw last night and that expresses a common sentiment (copied word for word):

"ATTENTION MEAT CONSUMERS....... As the packers continue to raise box beef prices to ridiculous prices spreads I would like to point out a few details. Right now with their box beef prices they are selling, it makess average fat cattle worth $235.71 per hundred weight in the meat. Translate that to what cash fat cattle should be worth is approximately 63.5% of the hanging weight. $235.72×63.5%= $149.67 per hundred weight is what cash fat cattle should be worth at that high of box beef prices. The average fat cattle prices this week have been $1.05 to $1.10. The packers are also getting a drop credit value at $107.72 of those cattle. If you take $149.76 what they should be worth -$110.00(at best)= $39.76 per hundred price difference. So if their butchering cattle weighing a average of 1,400lbs you take 14×$39.76=$556.64 profit to the packers. Wait you forgot to ad their bonus onto that! $107.72+$556.64= $664.36 PROFIT TO THE PACKERS!!!!!!! the farmers are LOSING $350 per head and the packers are PROFITING $664.36 per head. They are doing this with a smile everytime you go buy meat and sell cattle. Think about that for a minute."

But that math looks completely wrong. Assume fat cattle are $110/cwt, and assume a 63.5% dressing percentage. That makes cattle worth $173/cwt based on hanging weight. Then assume a beef cutout yield of 70%. That makes the boxed beef worth $247/cwt.

Now consider a 1400 lb finished steer with a hanging weight of 889 lb. Assume he has a yield grade of 3-4. He should yield about 70% of his hanging weight in retail cuts according to Oklahoma State University (http://4h.okstate.edu/literature-links/lit-online/animal-science-companion-animals/copy_of_beef/N-614_web.pdf/). Therefore, if our steer produces 622.3 lb of retail cuts and sells them at the price quoted in that Facebook post ($235.71), then the steer is worth $1466.82, or $104.8/cwt. The packer just lost $72.80 on that animal before the drop credit is factored in. According to the Facebook post, if the drop credit is $107.72, the packer gross profit per animal is $34.92. I frankly don't know how they're able to stay open at that price.

For the sake of discussion, here is a market report that we can use just so we're all on the same page: https://www.ams.usda.gov/mnreports/lm_xb402.txt

Here is a market report for drop credits, and it seems to be fairly in line with what was quoted in the Facebook post. The price is estimated at $7.57/cwt live weight: https://www.ams.usda.gov/mnreports/nw_ls444.txt

That is interesting, because the drop credit in 2013 was twice as much: https://www.roundupweb.com/story/2013/03/06/opinion/drop-credit-what-is-it/2230.html

This source summarizes what I'm saying:

https://beef-cattle.extension.org/what-does-the-phrase-drop-credit-refer-to/

Based on these numbers, the packing plants don't seem to be taking advantage of cattle producers at all. Can anybody challenge these numbers? I would like to be able to blame the packers for low prices as much as the next guy, but we have to use honest math.