GB, your post was an interesting one. I'm really not sure why the person you spoke of would be against cow/calf and for yearlings. Yearlings are far more risky for several reasons. It is interesting that she gave you so much information though.

What I see with people getting into cow/calf is the following….(not doing exact math here).

Cow/Calf….

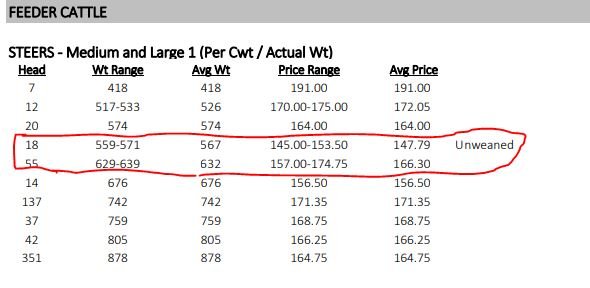

Person buys 100 cows for $100,000 with an annual payment of $23,000 for 5 yrs. They end up with a $450 per hd operating cost, mostly due to being new and not having the proper equipment for their area. They trailer wean 90 calves and sell at the local barn for a $700 avg or $63,000. So with an operating cost of $450 x 100 we're at $45,000 with a payment of $23,000 due at the bank. $45,000 + $23,000= $68,000. Well dang they lost $5,000.

You can see by the math they get easily disgruntled and eventually quit or just make it a hobby. What seemingly successful people see in the example above is that they made $18,000 and left another $15-20k or more on the table. So they start planning for the future and get operating cost to a manageable # and start the weaning/backgrounding process which, isn't easy and takes time. If you can make this work you end up with allot of equity and no cow payment in 5yrs but, you didn't make much for 5 yrs.

Yearlings….

Person buys the above persons calves at the sale for $63,000 with a loan from the bank, this way he has no real risk other than a mad banker. Person puts $150 a head in meds in feed in them through the winter then turns out on grass to finish. At this point they have $850 or $76,500 invested and it's free gain now. They sell when market is right for an $1,150 avg. 81 x $1,150= $93,150 -$76,500=16,500 in their pocket. I figured a 10% death loss in that.

First guy deals with cows and calves all yr and seemingly makes nothing second guy deals with some yearlings for 6-7 months and pockets an easy $16,500. But never builds any equity.

This is just a quick example of what I see in the guys I talk with. Most yearling guys I know run 6-8 truck loads once a yr as a sideline. They'll borrow $6-700,000 and hope to clear $70-80k. They are all pretty big operators.